B2B Price Research Methods to set list- and target-prices

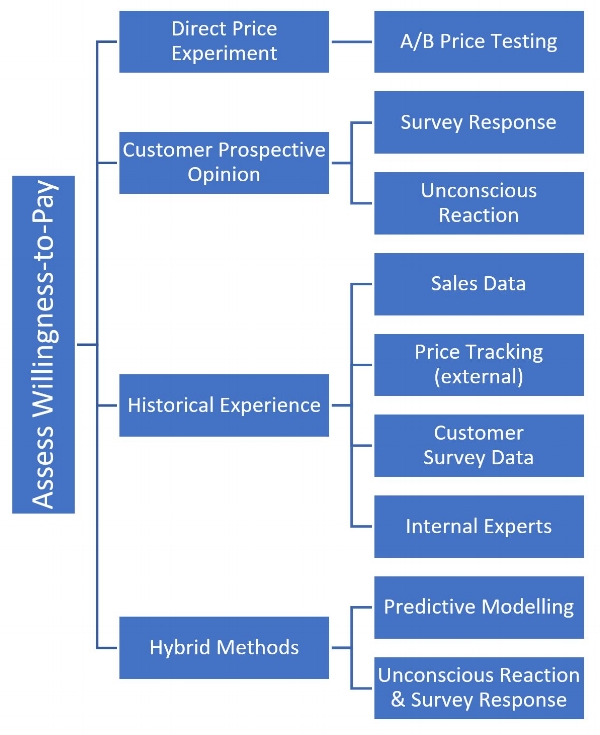

There are multiple techniques for assessing WTP

Having a robust way to assess customers Willingness-to-Pay (WTP) is a key capability required of all companies. It’s surprising to me how many B2B companies rely on gut-feel or ad hoc processes to get this done. This may be driven in part at least from not being familiar with the techniques, and the various challenges each presents, along with a more general lack of understanding of the importance of getting price right.

Techniques to estimate Willingness-to-Pay estimation can be grouped as follow (I’m taking a ‘big-tent’ approach so some techniques that give directional information are also included).

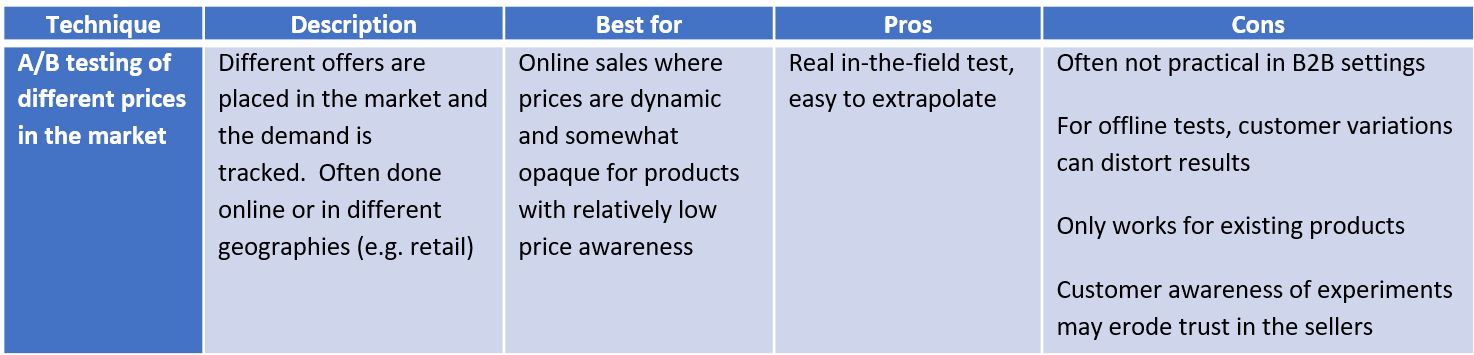

Direct Price Experiments

Testing different prices directly with customers during real purchasing decisions can give some great information on WTP, but is often difficult or risky, and only works when the product is in the market.

Table 1: Direct Price Experiments

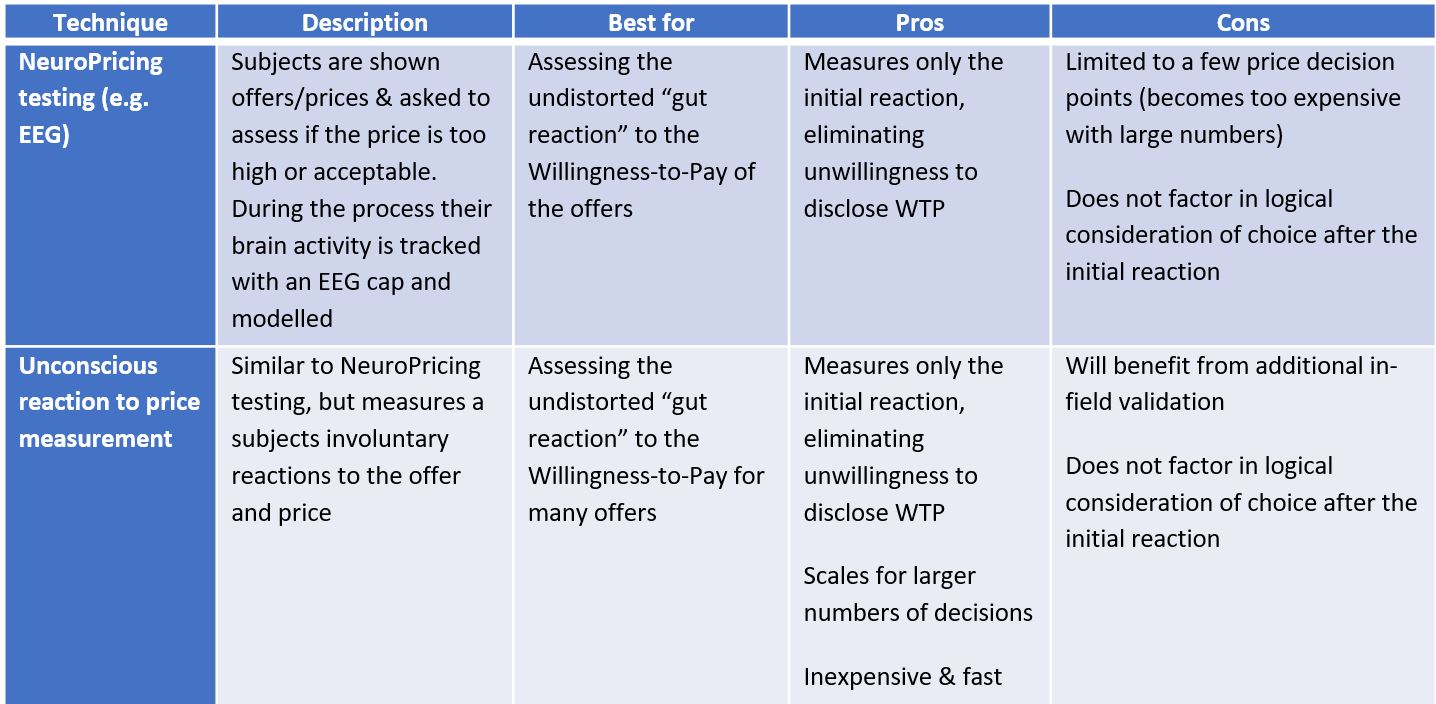

Prospective Price Opinion: Survey Response

These techniques ask customers directly how they would respond to different price points. They all run the risk of respondents being unwilling to expose their Willingness to Pay.

Table 2: Willingness to pay from direct price surveys

Prospective Price Opinion: Unconscious Reaction

These newer techniques test customers innate, unconscious reaction to the offered product and price. They have the potential to revolutionize pricing research!

Table 3: Unconscious price reaction testing

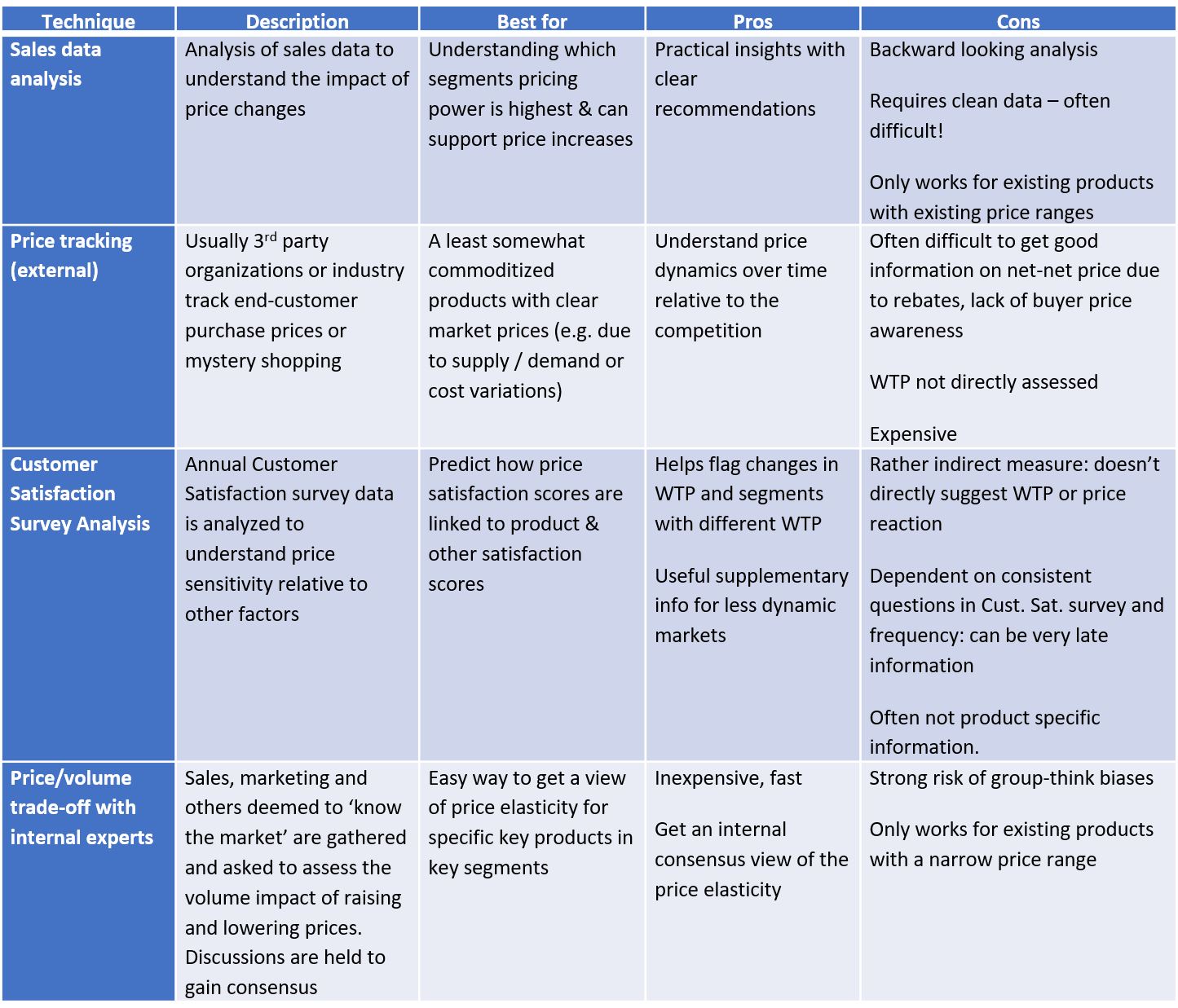

Historical Analysis: various techniques

Many of these techniques leverage existing data or insights to try to infer the Willingness-to-Pay and price sensitivity. In most cases they require the product to be in-market. They all suffer from being backward-looking.

Table 4: Historical price analysis

Hybrid methods

This is not really it’s own technique but is important since it highlights the power of combining various techniques above to generate predictions of price trends.

Table 5: hybrid price testing methods

Take-away summary

There is a wide variety of techniques that can give important insights to prices. Which to use depends a great deal on three factors:

- New or existing product(s)

- Number of products

- Importance of decision (driving size of investment in research). The table below summarizes the options available against the first two of these factors*

Table 6: when to use each technique.

* Note BPTO excluded since it focuses on brand, regardless of the number of products

Careful assessment of the most important techniques to use for your business can have an excellent ROI efficient use of your market research and analysis budgets.

The author being tested for any pricing thoughts

Do you have any other techniques you use? Which are most effective? Who do you see doing this well in the B2B space and what can we learn from them?

Contact me if you’d like to review which techniques to use for your specific situation: ian@eenconsulting.com.

I'm grateful to Prof. Dr. Kai-Markus Mueller of the Neuromarketing Labs for his help ort with this article.